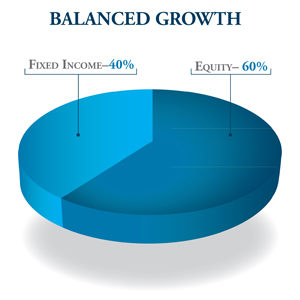

This core strategy seeks a balance of growth of principal value and income. The long-term goal is asset growth while attempting to keep market fluctuations at a moderate level. The portfolio is structured around a long-term strategic allocation which principally invests in a diversified equity portfolio of large, small and mid cap stocks and international stocks and allocates a moderate portion of the portfolio in fixed income investments. The Balanced Growth portfolio will typically be invested in approximately 60% equities and 40% fixed income investments. The portfolio management team may make tactical allocation adjustments from the target when they believe market conditions warrant changes. This portfolio may appeal to those individuals in need of a diversified portfolio strategy and who have a moderate (three to seven years) time horizons and desire moderate levels of risk and return.

This core strategy seeks a balance of growth of principal value and income. The long-term goal is asset growth while attempting to keep market fluctuations at a moderate level. The portfolio is structured around a long-term strategic allocation which principally invests in a diversified equity portfolio of large, small and mid cap stocks and international stocks and allocates a moderate portion of the portfolio in fixed income investments. The Balanced Growth portfolio will typically be invested in approximately 60% equities and 40% fixed income investments. The portfolio management team may make tactical allocation adjustments from the target when they believe market conditions warrant changes. This portfolio may appeal to those individuals in need of a diversified portfolio strategy and who have a moderate (three to seven years) time horizons and desire moderate levels of risk and return.

In this Section:

- Capital Preservation Model

- Stable Income Model

- Conservative Income Model

- Balanced Growth Model

- Capital Appreciation Model

- Aggressive Growth Model