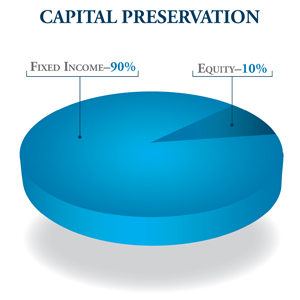

This core strategy seeks stability of principal value with an emphasis on current income. The model portfolio does not seek long-term growth and appreciation but instead seeks to minimize market value fluctuations. The portfolio is structured around a long-term strategic allocation which principally invests in a diversified fixed income portfolio and allocates a relatively small portion of the portfolio to a diversified portfolio of large, small and mid cap stocks. The Capital Preservation portfolio will typically be invested in approximately 90% fixed income investments and 10% equities. The portfolio management team may make tactical allocation adjustments from the target when they believe market conditions warrant changes. This portfolio may appeal most to those individuals who are in need of a diversified investment strategy and are interested in income and safety of principal. This choice may be appropriate for those investors with very short investment time horizons (one year or less).

This core strategy seeks stability of principal value with an emphasis on current income. The model portfolio does not seek long-term growth and appreciation but instead seeks to minimize market value fluctuations. The portfolio is structured around a long-term strategic allocation which principally invests in a diversified fixed income portfolio and allocates a relatively small portion of the portfolio to a diversified portfolio of large, small and mid cap stocks. The Capital Preservation portfolio will typically be invested in approximately 90% fixed income investments and 10% equities. The portfolio management team may make tactical allocation adjustments from the target when they believe market conditions warrant changes. This portfolio may appeal most to those individuals who are in need of a diversified investment strategy and are interested in income and safety of principal. This choice may be appropriate for those investors with very short investment time horizons (one year or less).

In this Section:

- Capital Preservation Model

- Stable Income Model

- Conservative Income Model

- Balanced Growth Model

- Capital Appreciation Model

- Aggressive Growth Model